From the vast complexity of running personal finances, there are game changers – either the ease with which planning of financial activities becomes easy or insights that get personalized to help users take better decisions about budgeting, investing, and saving money. With AI running the systems, financial planning becomes smarter, faster, and efficient. And here are the facts for the top 10 AI finance tools that’ll revolutionize your money management approach.

Why You Need AI Finance Tools

The managing of personal finance is very cumbersome. From the usual day-to-day expenditures to long-term objectives like retirement, you would need to be sure that investments are on optimal terms; personal finance planning has a lot of moving parts. And here’s where AI finance tools come in.

Why Use AI Finance Tools?

● Automation of mundane work: The AI finance tools automate all mundane jobs such as budgeting, expense tracking, and investment monitoring. They save a lot of time while eradicating most of the human errors.

● Personalized Insights: They analyze your financial data to provide you with person-specific suggestions that whether you need to save more, cut out something unnecessary, or find a new opportunity to invest. AI learns from your financial behavior and goals while suggesting what suits you personally.

● Real-time tracking: AI finance tools also give you insights on the financial situation in real-time. It tracks all weird transactions, while monitoring the performance of investments and keeps you in control of finances at the right time.

Better algorithms for AI will give much deeper insights into using them in decision-making but smarter, which means your choice will be much better. Of course, this might involve either the optimization of your portfolio or just ways to save; such insights are backed by data and thus more reliable.

Makes Financially Confusing Things Easy for Strangers: Most persons are blessed to have AI tools that make things easy and clearer to action over very technically perplexing things related to finances such as tax optimization and investment diversification.

How to Choose the Best AI Finance App

You have pretty much a lot of choices. Best AI finance application will really depend on exactly what you need, want, and financially. Taking into consideration the following:

● What is the big difference? The right thing for your needs. Do you want to budget better and organize how you spend? Then something like YNAB or Mint would be good for you. Do you need to manage and grow your investments? Well, then Personal Capital or M1 Finance will be in your best interest. You will know which of the two fits the need if you know what your goals are.

● Ease of use: Not all tools are the same when it comes to ease of use. If one is a newbie or likes plain simple, intuitive-based, look for some tools like Wally or Albert, and strength is on ease of use. Other than that if one is comfortable with using spreadsheets and requires more control over personalization, Tiller Money is a great one.

● Automation vs. Control: For example, while full automation can be very much an all-or-nothing, in terms of taking the investment side, for example, M1 Finance is more an all-or-nothing approach, others will allow you to have much better control of managing your finances. Determine how much of a do-it-yourself fanatic you want to be with your finances or find something that is a good middle ground between automation and doing it all yourself if you prefer which is kind of a hybrid approach. Quicken is a good example.

● Pricing: Consider how much you are willing to pay for the tool. While there are free tools like Mint and Clarity Money, others like YNAB or M1 Finance come with a tag. Make sure that the features you want for your budget are in your budget.

● Other Features: All the tools offer something different. If you are managing finances as a couple, then Zeta should be the ideal one due to the features it offers in joint financial planning. In case you need something more crucial for tracking your subscriptions, then Clarity Money would suit you better. Always think what extra you will get on that tool and how well it suits your requirements.

Top 10 AI Finance Tools

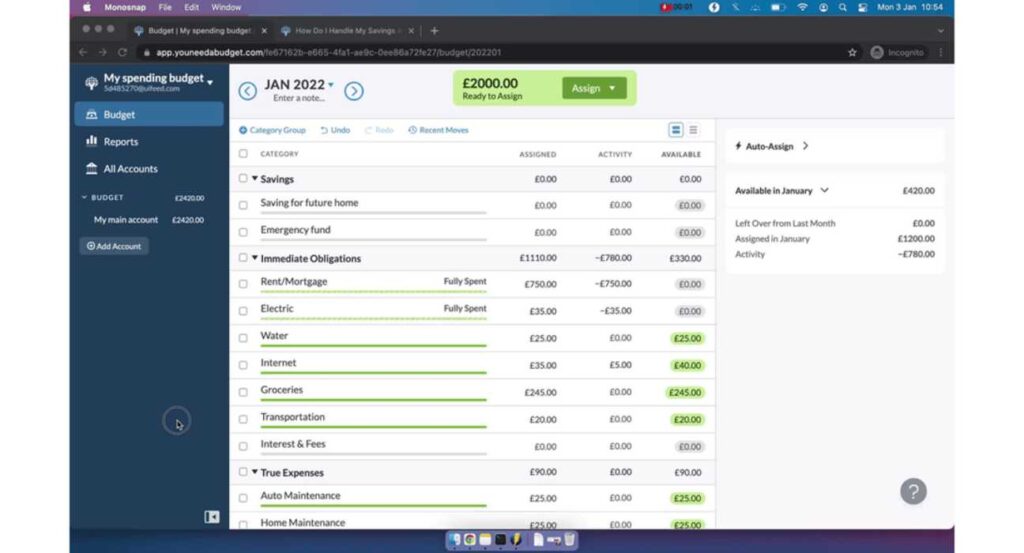

YNAB

- Best for: Budgeting and Financial Organization

- Price: $14.99/month or $98.99/year

YNAB is an AI budgeting app that’s focused on zero-based budgeting. Every dollar will be accounted for, and then spent on purpose rather than sitting dead in a checking account. Insights from AI will challenge spending and financial goals.

Pros

- Allow zero-based budgeting

- Updates the budget in real time

- Complete financial planning tools

Cons

- More complex for new users

- Doesn’t track investments

Website: YNAB

2. Mint

- Best For: Managing Personal Finances

- Pricing: Free; Ads

Mint is an artificial intelligence financial management system that aggregates all your accounts into a single location. It tracks every single expense, gives you budgeting recommendations, and also offers your overall financial health rating. Mint’s AI categorizes every transaction and provides personalized saving and spending suggestions.

Pros

- Free

- Tracks every single one of your financial accounts in one place

- AI-driven savings and spending recommendations

Cons

- Ads are intrusive

- Somewhat inflexible investment tracking

Website: Mint

3. Personal Capital

- Best For: Investment Management and Wealth Tracking

- Pricing: Free basic tools; advisory services start at 0.89% of assets under management annually

Personal Capital includes AI-driven financial analysis with human advisory services. It allows tracking of investment as well as retirement in one platform and finding optimization for your portfolio. The AI tools present risks and suggestions and also offer tax optimization insights for investments.

Pros

- Tracks full investments and retirement options

- Optimize portfolios through AI

- Delivers unusual personalized advice on finances

Cons

- Services such as paid subscriptions become pretty pricey to smaller portfolios

- Budgeting features also somewhat limited

Website: Personal Capital

4. Quicken

- Best For: Holistic financial management

- Pricing: Starting at $41.88/year

Quicken is a potent tool in AI finance management that updates everything from daily expense tracking to investment updates on the portfolio. The software offers very detailed reports and budgetary advice based on the user’s details on their finances. Quicken AI tools allow the users to keep track of the spending patterns of their families while giving long-term planning ideas.

Pros

- AI-based financial analysis

- Good reporting capabilities

- Budgeting, debt management, and investment tracking

Cons

- Hard interface

- It’s available in a subscription-based pricing scheme

Website: Quicken

5. Tiller Money

- Best For: Spreadsheet-Based Budgeting

- Pricing: $79/year

Tiller Money auto-feeds your financial data into Google Sheets or Excel and manages your personal budget with spreadsheets, customized according to your requirements. The AI-driven tool helps you create personalized budgeting, debt, and investment plans based on the customized templates.

Pros

- Completely customizable spreadsheets

- It automatically feeds in the data

- Financial management is flexible as well as detail-oriented

Cons

- You have to be involved with spreadsheets

- It does not track direct investment

Website: Tiller Money

6. Albert

- Best For: Automatic Savings and Investments

- Pricing: Free basic tools; Albert Genius starts at $8/month

Albert is an automatic finance assistant that saves for you as you spend. It goes a step further to offer personalized finance consulting and investment advice, making it ideal for users who want to save and make money easily.

Pros

- Auto savings feature

- Personalized investment and finance consulting

- User-friendly, simple interface

Cons

- Costlier for advanced features

- Limited investment tracking

Website: Albert

7. Zeta

- Best For: Couples and Family Financial Planning

- Pricing: Free

Zeta is designed for couples and family usage. It features an AI-powered platform that allows couples to track coordinated expenses, set savings goals, and get personalized advice on shared money management. This makes it perfect for co-planning.

Pros

- Simplifies co-planning finances

- AI-powered insights for couples

- Tracks shared expenses smoothly

Cons

- Few tools available for individual use

- No direct investment tracking

Website: Zeta

8. M1 Finance

- Best For: Investing and Portfolio Management

- Pricing: Free basic tools; M1 Plus starts at $125/year

M1 Finance automates investments using AI technology, allowing users to create customized portfolios, known as “pies.” The AI then automates the buying and selling of assets to maximize returns, rebalancing portfolios based on market changes.

Pros

- AI-driven portfolio management

- Automated investment and rebalancing

- Low fees for basic users

Cons

- Limited investment options for advanced users

- M1 Plus is relatively expensive

Website: M1 Finance

9. Wally

- Best For: Personal Budgeting and Expense Tracking

- Pricing: Free; premium version available

Wally is an AI-based personal finance tool designed to help users monitor their expenses in real time. It provides deep insights into spending habits and helps individuals stick to their budgets while achieving their financial goals.

Pros

- Supports multi-currency

- Real-time expense tracking

- AI-based personal budgeting advice

Cons

- Premium features can be expensive

- Limited investment tracking options

Website: Wally

10. Clarity Money

- Best For: Expense Management and Subscription Tracking

- Pricing: Free

Clarity Money is an AI app that helps users track expenses, manage subscriptions, and offers personalized savings recommendations. Its ability to continuously monitor spending and track recurring payments simplifies month-to-month financial planning.

Pros

- AI-powered subscription management

- Tailored savings insights for each user

- Simple, clean interface

Cons

- No advanced investment features

- Lacks comprehensive budgeting tools

Website: Clarity Money

Conclusion

Accordingly, the selection of which AI finance tool to opt for would strictly depend upon your individual requirements: it might just be for budget management, tracking investments, or even tracking your expenses. Still, surprisingly, these tools become that potent for the level of efficiency they promise to bring in when considering tasks. From budgeting guru YNAB to M1 Finance automated portfolio management, the list goes as far as one’s eyes can see. Check them out and start down the road to smarter financial management.