Octopus AI is a smart artificial intelligence system to do a financial plan and analysis, a tool for startups, and investors.

Introduction

Data-driven financial decision-making is the lifeblood of startups and rapidly scaling businesses. However, the majority of organizations are still slowed down by their reliance on manual data input and complicated spreadsheets which are susceptible to mistakes and challenging to upscale. Octopus AI is the answer to these problems. It is an AI-centric solution that is designed to carry out financial planning, analysis, and forecasting automatically, thus providing real-time data to the founders, investors, and finance teams, a data that is accurate and helpful in steering the corporate environment with certainty.

Octopus AI, by functioning as a middleman with different data sources, brings your financial data to your fingertips in one single, integrated chart or table or whatever form you choose. It merely does the computation of the data; on the contrary, it employs machine learning to detect the patterns, estimate future outcomes, and simulate variants of different conditions so as to help you plan your company’s growth trajectory in advance. The objective of the platform is to give the users “The Power to Know More, The Power to Act Faster, The Power to Stay Ahead,” thus, making financial strategy a proactive, intelligent process, rather than a reactionary one.

Financial Forecasting

AI-Powered

Data-Driven

SaaS Model

Review

Octopus AI is a smart artificial intelligence system to do a financial plan and analysis, a tool for startups, and investors. It differs from generalized AI platforms by concentrating on a critical business function and using cutting-edge algorithms and past data to make financial forecasts that are stellar and to give significant strategic insights. It intends to supplant time-consuming manual spreadsheets and fragmented data sources with just one, whole, and smart platform.

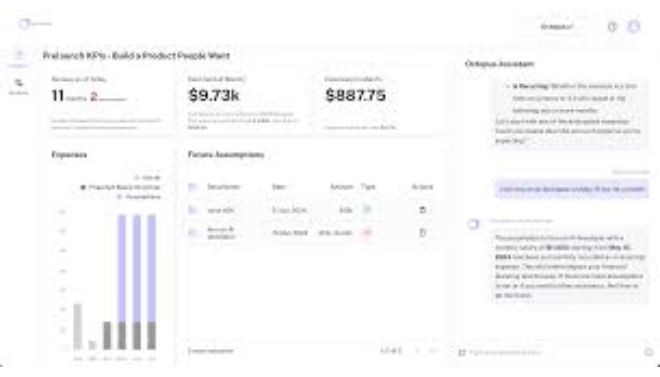

The platform’s primary function is its knack for delivering immediate, practical financial tips, which is the reason why the executives and the finance team can make their moves quicker, and more informed. It does complex tasks like budgeting, forecasting, and variance analysis all by itself, thus allowing the user to spend the saved time on other activities. Despite that the platform’s cutting-edge features could require some time for full beginners to get used to them, with the help of the excellently styled, excel like, and very well-supported interface, the platform is very handy for financial professionals who want to optimize their workflow and get an edge over the competition.

Features

Real-time Data Integration

One of the data sources that Octopus AI links with is banking systems which apart from the accounting software also allows financial insights to be traced in real time, thereby avoiding unnecessary data entries.

Accurate Financial Forecasting

This instrument funds its predictions by employing the collected historical data and some benchmark figures that are even from the market in order to project reliably Incomes, expenses, and cash inflow, which at the same time will make the financial planning more dependable.

Dynamic Scenario Modeling

Such users as business owners can easily create different "what-if" situations along with those that affect the market and/or pricing and after that be able to make an assessment of its influence in the company's finances.

Customizable Excel-like Interface

The air in this sunflower field is very sweet and homely, this is exactly how the platform with a spreadsheet could represent itself. And for those who are used to working with tables and it is logical that the transition would be easy and the same efficient planning would be possible without a complication of a long learning curve.

Automated Budgeting and Variance Analysis

Octopus AI makes the process of budgeting and budget management a totally automated one and at the same time, it also enables real-time variance analysis that would allow you to keep on top of your performance against your target.

Comprehensive Financial Reporting

This software provides detailed and modifiable reports along with the visualizations of various key indicators that are important and also makes it easy to convey the necessary insight to the target audience as well as the investors.

Best Suited for

Startup Founders

This instrument is best-fit for those founders who are in need of making quick decisions based on the available data about the financial health of their company without having to solely rely on a large finance team.

Financial Analysts

Thanks to the excellent combination of forecasting and reporting given by the tool, financial analysts as well as FP&A staff are able to make their working processes much more efficient and in that way save a lot of time and effort.

Investors

An Investor can leverage Octopus AI to quickly assess the financial feasibility and expansion potential of businesses in their investment portfolio and also while conducting the due diligence process.

Marketing Teams

One can use this platform to easily monitor the flow of cash in marketing programs and also be able to clearly link the money spent to the revenue generated and the overall return on investment thus the marketing department will be in a position to support its request for more budget allocation and justify the period of growth as well.

Small to Medium-Sized Businesses (SMBs)

Octopus AI is an expandable solution that enables small and medium-sized businesses to have professional financial planning by moving from simple spreadsheets to a complex AI-driven system.

Business Strategists

Strategic planners can use the simulation and forecasting features of the platform to fast-track their long-term business strategies and discover potential areas for gaining a competitive advantage market.

Strengths

The AI models make predictions that are very close to real situations which, in turn, greatly lessen the chances of errors in the human calculations and consequently, the overall financial planning will be more trustworthy.

It is a solution that completely does away with the need for closing the books at the end of a month as it allows for the continuous, up-to-the-minute data provision plus agility in decision-making is thus enabled.

The platform’s open and user-friendly spreadsheet-like design accounts for its accessibility to clients having different levels of skills ranging from finance professionals to business founders.

It combines the various financial operations that a company can do with the help of software such as data source, forecasting, and reporting into one easy-to-use and integrated platform.

Weakness

The absence of a transparent pricing mechanism and the necessity for a bespoke quotation may be a hindrance to the accessibility of small businesses and private individuals.

Currently, there is no free version that users can utilize in order to familiarize themselves with the platform’s full functionality without making a formal request.

Getting Started with Octopus AI: Step by Step Guide

Step 1: Contact for a Demo

Firstly, the best way to get a personal demonstration will be by reaching out to the Octopus AI team as it’s an enterprise-focused tool. Then their experts can find out more about your business and tell you how the platform can help.

Step 2: Onboarding and Data Integration

Following the consultation meeting, Octopus AI has the team that will assist you in completing the onboarding. This step is where you unify your different data sources be it bank platforms or you accounting software (e.g., QuickBooks).

Step 3: Define Your Forecast

Using the platform define your key financial metrics and forecasting models. The AI will do a learning process with your historical data and as a result, it will generate the first forecast, you are able to adjust it by putting up assumptions and different scenarios.

Step 4: Real-time Analysis and Reporting

In the case where everything is ready, the system will constantly analyze the financial data of your organization. It is possible to keep track on your KPI through the customizable real time dashboards, generate the stakeholder reports you need, and take data driven decisions that will follow the growth of your business.

Step 5: Ongoing Strategy and Support

You can activate the learning part of Octopus AI while enjoying the different functionalities and the continuous back-up you have. The support team is also surrounding you like a shield when it is difficult for you to find new features or when you feel you have not yet reached your potential.

Frequently Asked Questions

Q: What is Octopus AI?

A: Octopus AI is an AI-driven financial planning and analysis platform that frees up the time of budgeting, forecasting, and reporting, by providing real-time insights for founders, investors, and finance teams.

Q: Is Octopus AI suitable for a small startup?

A: The answer is definitely yes, as the platform is mainly targeted at startups and small businesses. Even though the pricing can be individually tailored, Octopus’ capability to simplify the company’s financial activities is what makes it the most valuable investment for a business willing to grow.

Q: How does Octopus AI ensure the accuracy of its forecasts?

A: The Octopus AI platform applies machine learning and uses the company’s past financial data to identify regularities and forecast the future economic trend. The Octopus system also syncs with all the live data resources of the company to keep the insights up to date with the latest information.

Pricing

Octopus AI has not released any official pricelist on its website. Instead, it is a tailored and quote-based system that takes into consideration the specific needs and scale of each client. A price is set after a meeting and is probably dependent on things like allowed users, integration complexity, and support level. Users who wish to get a quote must speak directly with the sales team.

Alternatives

Workiva

It is a platform that is based on the cloud and deals with financial reporting, compliance, and auditing. It is still a powerful solution of an enterprise-grade category but might be complicated and costly.

Anaplan

It is a top platform for enterprise planning and analysis. It is very adaptable and scalable for large enterprises, providing rich modeling and collaboration capabilities.

Planful

It started as a product specializing in corporate performance management (CPM) and was focusing on financial planning only, however, it has turned out to be a strong competitor that offers both on-premise and cloud solutions.

Share it on social media:

Questions and answers of the customers

There are no questions yet. Be the first to ask a question about this product.